A friend of mine recently asked me about cryptocurrencies. I gave him the short story, but I'll post the long story here as well, for anyone interested.

What's the point?

In its most basic form, a cryptocurrency is a list of balances in accounts. Only people that have the password to an account can spend the balance in it, using a "wallet" application.

However, a bank account offers the same function so far.

- One difference is that the bank account uses a government currency as a unit, but a cryptocurrency account uses just made-up numbers.

- Another difference is that anyone can begin validating transactions for cryptocurrencies, not just a central authority middleman (the bank).

Why would anyone trust made-up numbers?

The history of money is long, and I won't pretend I can explain all of it, but here's the gist of it.

A long time ago, people used gold and silver coins to trade. While this allowed great financial freedom, it is not very convenient to carry chunks of metal around with you all the time. Then, banks appeared, which let you use bank notes instead of the heavy chunks, and they would store your metals.

Then, fractional reserve banks were invented - banks would print more bank notes than they had gold, and lend it to people. See a comprehensive clarification in these Khan Academy videos.

But more recently, the government and the central bank decided to just print pretty much unlimited money and do bad things with it.

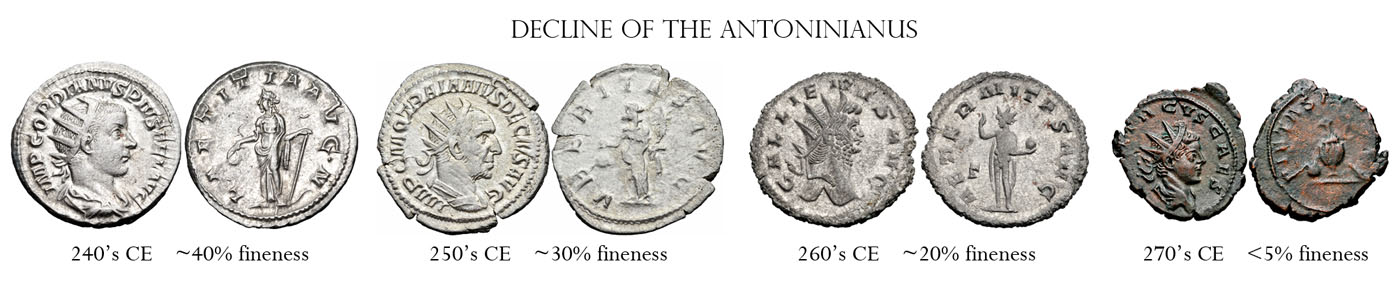

This rewards the reckless risk-takers and the government, while it punishes diligent and responsible people, and can lead to the fall of civilizations. Rome fell in part because of its currency debasement.

Without a constant influx of precious metals from an outside source, and with the expense of continual wars, it would seem reasonable that coins might be debased to increase the amount that the government could spend. A simpler possible explanation for the debasement of coinage is that it allowed the state to spend more than it had. By decreasing the amount of silver in its coins, Rome could produce more coins and "stretch" its budget. As time progressed, the trade deficit of the west, because of its buying of grain and other commodities, led to a currency drainage in Rome.

There are two kinds of inflation:

- Money supply inflation, which is the increase in amount of money existing (the money printing I mentioned earlier)

- Price inflation, which is the increase in prices as a result of increased spending; it directly erodes purchasing power, and is a consequence of the money supply inflation.

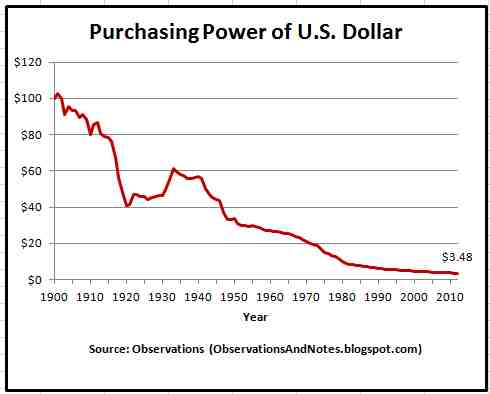

The bigger the money supply, the more people have available to spend, and the more prices are driven up (unless people save the money). In general, since central banks love to print money, $100 today will buy you fewer goods and services than $100 a year ago.

A chart here shows that $100 today can be used to buy goods worth only $3.48 in 1900 dollars - though you still pay the same $100 face value. This is quite a drop in purchasing power.

In Romania, the country I'm from, the central bank decided to print a lot of money following the 1989 revolution. The official consumer price index is only available in RAR archives and only from 2002, which makes it pretty useless, but we can compute a more useful approximation of price inflation for ourselves.

A kilogram of bread was around 4.4 Lei in 1970, and today, 2019, 2 loaves of 500 grams be worth around 2 * 2.82 = 5.64 RON. But note the difference in the unit: a RON (Romanian New Leu) represents 10000 ROL (Romanian Leu - the old one).

This translates to a 12818.18-fold devaluation over 49 years, or an average geometric price increase of 12818.18 ^ (1/49) - 1 = 21.3% per year. Any saver would have seen their savings wiped out of existence. Clearly, saving or holding Lei or RON should not be done. Perhaps this is why Romania suffered (or is still suffering?) a brain drain.

However, with cryptocurrencies, you can mathematically determine the money supply, and have a safe guarantee of what it will be in the future. For instance, there will never be more than 21 million Bitcoin, and the monetary inflation will reach essentially zero by around 2040. However, the creator(s?) of Bitcoin decided to use some inflation, in order to stimulate adoption.

Of course, the actual market price of cryptocurrencies will not only depend on the supply, but also on the wildly varying demand.

Still, in a way, the "made-up" numbers proposed by cryptocurrencies are less made-up than the ones in people's bank accounts. One can use cryptocurrencies as a hedge against inflation - similar to storing oil, gold, copper, paintings, or houses, instead of holding money that is losing its purchasing power constantly.

Yet more advantages of cryptocurrencies

Suppose you are a journalist involved in exposing powerful, corrupt politicians in your country. They have frozen your bank accounts.

You are having trouble paying for food, let alone paying for a bodyguard which you desperately need. What do you do?

Well, cryptocurrencies are the newest answer. Using cryptocurrencies, you can generate an account using a wallet application on your computer or phone, and accept donations by publishing your account's address. Your patrons can send you cryptocurrencies there.

The government would find it very difficult to block your cryptocurrency account, since you could transact even on paper (using QR codes or just writing down hex code).

Disadvantages of cryptocurrencies

Not everything is rosy, though.

-

Price variation

Since cryptocurrencies are in their infancy, demand for them is wildly fluctuating. One should be prepared to lose all their money - for no other reason than people rejecting them as payment. For instance, Bitcoin lost 92% of its value between June and November 2011.

-

Technical/security risks

People need to be apt at computer security in order to hold significant amounts. Wallet files are magnets for viruses. In addition to one's password being copied off one's backups and fake wallets sending money to attackers, there may also be some bug in actual cryptocurrency network implementations - like one found last year in ZCash that allowed counterfeiting (but was fortunately not exploited in the wild).

-

Increased costs

Right now, fees for Bitcoin transactions are big, over 1 USD. While there are other cryptocurrencies with smaller fees, it's hard to know how they will behave as they scale. It's fundamentally more difficult to keep a distributed network than to just have one central authority that processes payments (like a credit card company).

-

Politics / legal

There may be missing or even hostile legislation for how one should treat cryptocurrencies. There might be power-hungry central banks banning them (such as Russia's, India's, and China's), for various reasons including terrorism, money laundering, and price instability.

Opinion: I think these reasons are quite baseless, and should not lead to banning.

- Terrorism means expressing your point of view using violence. While I sternly condemn any violence, I am a strong supporter of freedom of speech. Just because terrorists use cryptocurrencies doesn't mean we should ban them - terrorists also use roads, trains, planes, and spoons.

- Money laundering: of course the government won't like people performing tax evasion. But that doesn't mean anonymous financial payments should be forbidden. A government should do its job without infringing upon financial privacy (see the journalist example above). If a government, say, imposes a ceiling on cash transactions, not only does it fail to meet its purpose (criminals will transact illegally and invisibly anyway), but it significantly reduces financial freedom for honest citizens.

- Price instability: I think this is a joke. Anyone buying anything should be aware of the risks of what they are buying. The government should not ban people from assuming risks - it would lead to much greater risks (similar to clandestine breweries during the Prohibition). Of course, the government should not "save" people from the risks either.

What cryptocurrency should I choose?

In case you're insane enough to want some of this, stay tuned. Another article is coming up soon. I will review some currencies:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Monero, ZCash

- Ripple, Stellar

Have fun!

Edit 2019-09-02: Here is the article!

danuker | freedom & tech

danuker | freedom & tech

Comments